Percentage of Net Sales Method Definition, Formula & Example

Content

For example, assume your small business generated $10,000, $15,000 and $17,000 in each of the past three years. Add these together to get $42,000 in total credit sales in the past three years. The percent of sales method is one of the quickest ways to develop a financial forecast for your business — specifically for items closely correlated with sales. If your business needs a very rough picture of its financial future immediately, the percent of sales method is probably one of your better bets.

The calculator will display the percent of sales the item is attributing to the total. Create a pro-forma balance sheet if the next year’s sales forecast is $45 million. The information from Example 3 may be used to calculate the https://www.bookstime.com/articles/percentage-of-sales-method forecasted retained earnings. For example, at the end of the accounting period, your business has $50,000 in accounts receivable. When accountants record sales transactions, a related amount of bad debt expense is also recorded.

Percentage of Net Sales Method FAQs

To demonstrate the application of the percentage-of-net-sales method, assume that you have gathered the following data, prior to any adjusting entries, for the Porter Company at the end of 2019. For example, if the CGS ratio increased to 65 percent next year, management would have to examine why their production costs are increasing relative to sales. This could happen because of a number of supply issues or environmental changes. Material prices or utility rates could have gone up uncontrollably during the year for example. For the sake of example, let’s imagine a hypothetical businessperson, Barbara Bunsen.

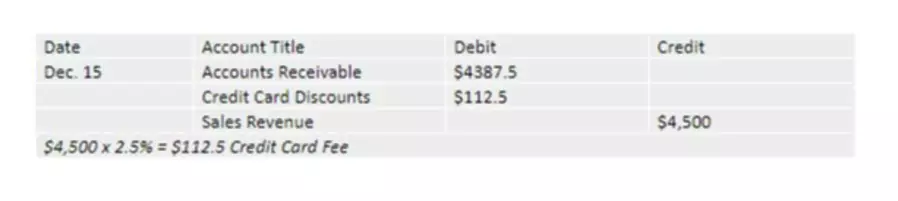

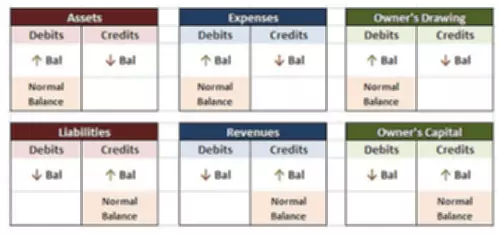

These tools contribute to an accurate forecast needed for an organization’s financial planning. This approach does not consider the balance in the allowance

for doubtful accounts because such balance is not used in the calculation of

bad debt expense. The percentage-of-sales method is used to develop a budgeted set of financial statements.

Step 1

Most businesses think they have a good sense of whether sales are up or down, but how are they gauging accuracy? With shifting budgets and different departments needing more or less from the company every month, having a precise account of every expense and how it relates to future sales is a must. The reason for this https://www.bookstime.com/ is that it gives a more accurate picture of your financial health. Writing off these debts helps you avoid overstating your revenue, assets and any earnings from those assets. The first thing you must do to calculate sales percentage is gather data on the sales and business expenses your company or business has.

- This data encompasses sales and all business expenses related to sales, including inventory and cost of goods.

- For instance, if a customer buys a product from a business that has a step cost at 5,000 units, then every unit beyond those first 5,000 comes at a discounted price.

- While these numbers are only useful in the short term and the process needs repeating, the percentage of sales model allows businesses to make educated decisions about the direction their companies are headed.

- Additionally, it is recommended that companies periodically review their inventory costing methods to ensure that the Percentage of Net Sales Method continues to be the most appropriate for their needs.

- The percentage of sales to expenses method is the most common method of calculating the effects of sales on net income for budgeting purposes.

With the write-off method, there is no contra asset account to record bad debt expenses. Therefore, the entire balance in accounts receivable will be reported as a current asset on the balance sheet. This entails a credit to the Accounts Receivable for the amount that is written off and a debit to the bad debts expense account. Percentage of sales method is an income statement approach for estimating bad debts expense. Under this method, bad debts expense is calculated as percentage of credit sales of the period. For example, assume Rankin’s allowance account had a $300 credit balance before adjustment.

How to Do an Entry for Bad Debt Expenses & Allowances for an Uncollectable Account

The bad debt expense account is debited, and the accounts receivable account is credited. In applying the percentage-of-sales method, companies annually review the percentage of uncollectible accounts that resulted from the previous year’s sales. However, if the situation has changed significantly, the company increases or decreases the percentage rate to reflect the changed condition. For example, in periods of recession and high unemployment, a firm may increase the percentage rate to reflect the customers’ decreased ability to pay. However, if the company adopts a more stringent credit policy, it may have to decrease the percentage rate because the company would expect fewer uncollectible accounts. The percentage-of-net-sales method determines the amount of uncollectible accounts expense by analyzing the relationship between net credit sales and the prior year’s uncollectible accounts expense.

Best practices when using the Percentage of Net Sales Method include regularly monitoring sales figures and inventory levels to ensure accurate reporting and compliance with tax regulations. It is also important to establish controls and procedures to prevent the manipulation of sales figures. Additionally, it is recommended that companies periodically review their inventory costing methods to ensure that the Percentage of Net Sales Method continues to be the most appropriate for their needs. The Percentage of Net Sales Method works by assigning a cost to each item in the ending inventory equal to the percentage of net sales realized from that item during the period. When an item is sold, it is given a cost equal to its assigned percentage multiplied by the total net sales for that period. Add together the amount of credit sales you failed to collect in each of the past three years.

Percentage of Sales Assumptions

Small businesses that made less than $5 million had a 6.1 percent sales growth on average in 2017, said Sageworks. You may want to compare the percentage of sales to different categories of expenses in addition to total expenses. The downside to using the Percentage of Net Sales Method is that it can be subject to manipulation if sales figures are not properly monitored or reported accurately. Additionally, it does not take into account changes in inventory costs over time or fluctuations in the demand for certain products. Larger companies allow for a certain percentage of bad credit in their financial analysis, but many small businesses don’t, and it can lead to unrealistic projections and unforeseen loss. Next, Liz needs to calculate the percentage of each account in reference to her revenue by dividing by the total sales.

Based on this data, the debit to the uncollectible accounts expense is 2% of net credit sales of $1 million, or $20,000. Adjust the percentage of uncollected credit sales to reflect any changes that might affect your collections in the current period. Changes that might cause you to lower the percentage include an improving economy or an increase in creditworthy customers. In this example, assume overall economic growth will improve collections by 0.1 percent. Add together the credit sales your small business generated in each of the past three years. If you started your small business fewer than three years ago, add up the credit sales you generated since its inception.

Easily calculate drop-off rates and learn how to increase conversion and close rates. From sales funnel facts to sales email figures, here are the sales statistics that will help you grow leads and close deals. Read our ultimate guide on white space analysis, its benefits, and how it can uncover new opportunities for your business today. Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide.